Highlights

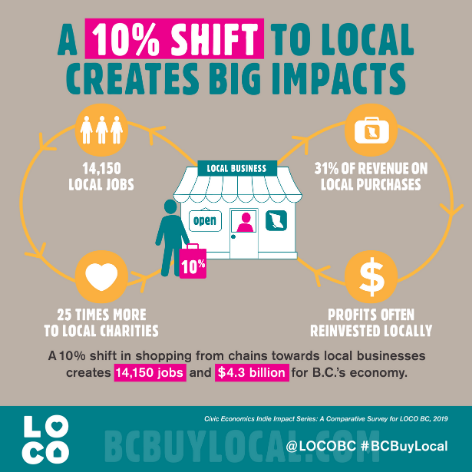

- Independent businesses recirculate up to 4.6 times more revenue in the local economy than multinationals

- Independent businesses recirculate up to $63 of every $100 in revenue in the local economy, compared to $14 for multinationals

- Independent businesses produce up to 8.4 times more jobs/ft2 & up to 8.1 times more revenue/ft2 than multinationals

- Independent businesses spend up to 31.4% of their revenue on B.C. products & services

- Independent businesses donate up to 24 times more per dollar of revenue to local charities that multinationals

- A 10% shift in B.C. consumer spending towards independent businesses would create 14,150 jobs & keep $4.3 billion in the B.C. economy

In early 2019, LOCO BC commissioned Civic Economics to conduct a study to determine the local recirculation impact of consumer spending with locally owned businesses. We felt it was important to update and verify similar B.C. data produced by separate 2013 studies by LOCO BC and Civic Economics.

This year we looked at the impact of brick and mortar retail stores and restaurants in three communities in the B.C.’s lower mainland to calculate the recirculation impact of local businesses located there, and compare it to the recirculation of similar multinational businesses. We worked with report sponsors: Buy Social Canada and Community Impact Real Estate Society (CIRES) in Vancouver’s Downtown Eastside (DTES), Newton Business Improvement Area in Newton, and the Township of Langley in Langley. The project was also supported by several business groups who assisted with outreach to businesses the Langley Chamber of Commerce, Downtown Langley BIA, Tourism Langley and BIAs in Gastown BIA and Strathcona.

The

The