Recent research points to a dire situation for B.C. businesses. This research determined the increasing cost of doing business for retail, restaurant, consumer service and office businesses in the City of Vancouver from 2018-2023 to identify actions to support businesses through Vancouver City Council and the City's new Business and Economy Office.

Our research found that increasing costs impede the survival of City of Vancouver businesses. Ninety-four percent of businesses reported experiencing cost increases in the last five years – 62% significant and 32% moderate. As a result, 59% of Vancouver businesses won’t last beyond four years if things don't change (7% more than the provincial average of 52%).

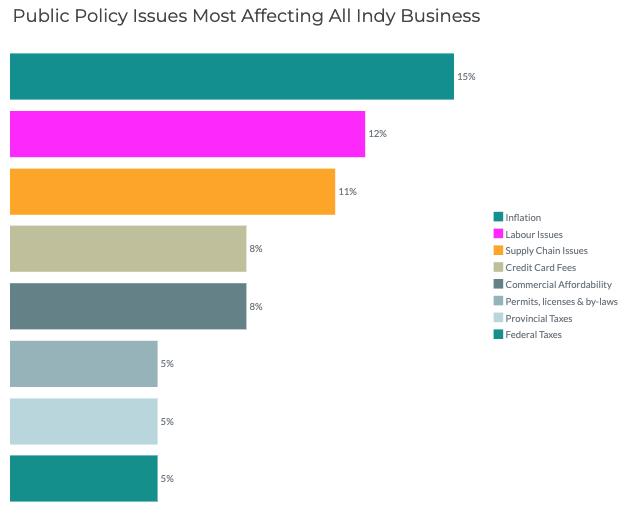

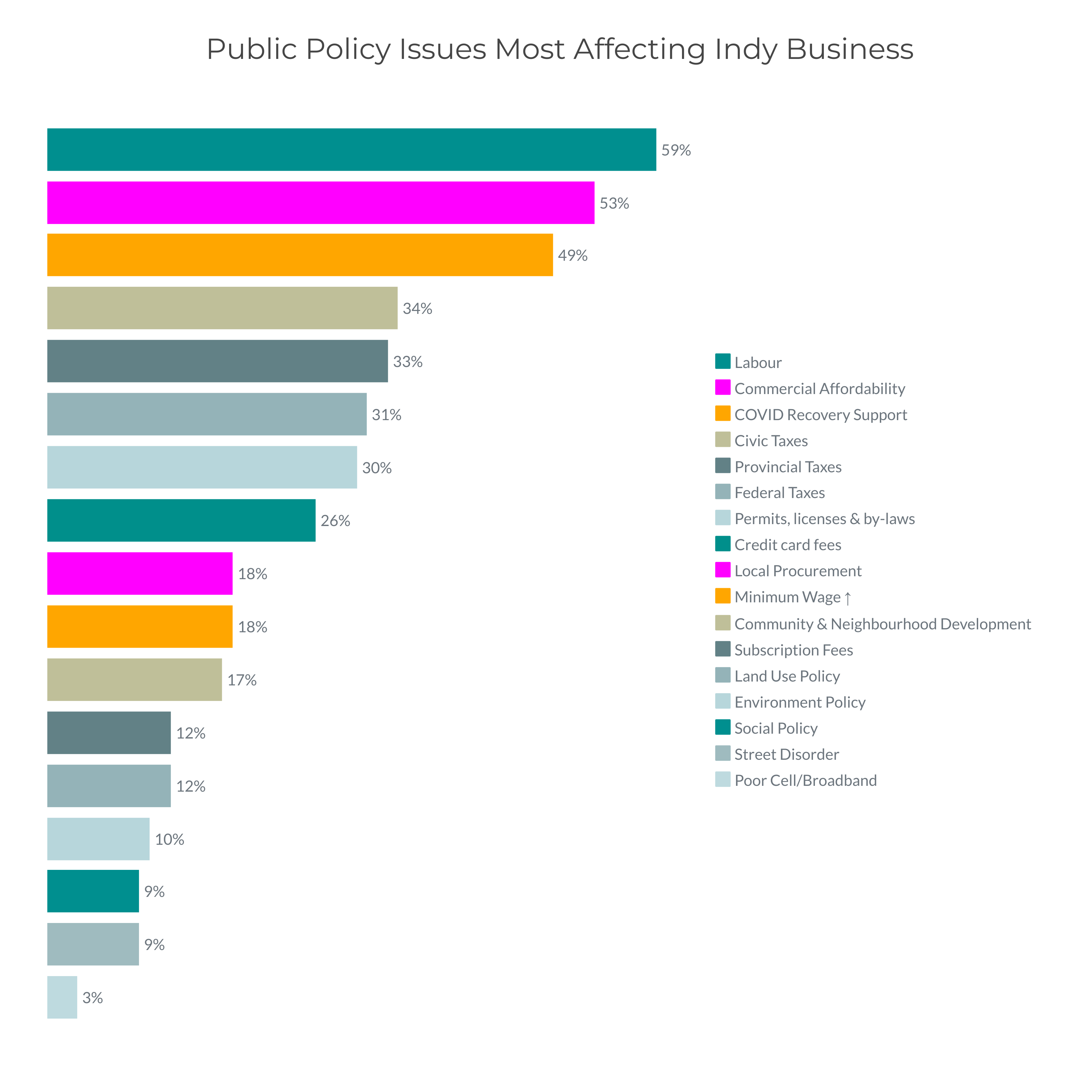

We determined that businesses in all sectors are experiencing dramatic increases in most of their hard costs, which are largely out of their control to manage. Businesses report an average cost increase of 25%. The top five factors contributing to cost increases were determined as: payroll, cost of goods sold (COGS), insurance, property tax, and lease costs. These factors were the same (in various orders) for all sectors except for the office sector, where “other business fees" (e.g., software) are a bigger contributor, and COGS is not as much of an issue.

Payroll is the top contributor to cost in every sector except food service, where inflation affecting COGS causes more concern. Employment costs have increased dramatically due to new government policies, increases in the cost of living, and a lack of affordable housing for workers. Employment cost increases are due to minimum wage increases (from $12.65 in 2018 to $17.60 in 2024), the Employer Health Tax (new in 2019), provincially mandated sick days (new in 2022), and costs related to attracting/retaining employees. Many businesses have had to increase wages significantly and offer employee benefits to compensate employees for the high cost of living in Vancouver. In the last five years, cost per employee rose 69% for Vancouver businesses, and cost per employee as a percentage of revenue has increased 33%. Overall employment costs have increased 40% compared to a 14% increase in employment.

COGS is the second largest concern overall, with 67% of businesses citing it as a top concern, estimating an increase averaging 18%. The food service and retail sectors have been most impacted, but the consumer service sector is also affected. Insurance costs are a top concern of 56% of businesses, as rates have increased an average of 94% in response to inflation, and increased risk due to claims related to property crime.

Property tax and lease costs are also top contributors to cost increases for more than half of businesses, with businesses experiencing average increases of 133% for property tax, and 70% for lease rates. About a third of businesses (33%) have experienced increases in both property taxes and lease rates. Consumer service businesses are most likely to be experiencing lease rate increases (71%), while food services businesses are most likely to be affected by property tax increases (64%).

Some of the cost increases facing businesses in the City of Vancouver are beyond the control of the municipal government. However, the City has the power to reduce many of the cost increases facing its business community, to ensure their survival through this challenging period. They can lessen the cost burden for business most directly in the areas of property tax increases (up 133% in the last five years), lease increases – when they are gross leases including property tax (up 70% in the last five years) and business fees paid to the City for business licenses and permits (up 132% in the last five years). The City can also influence insurance cost increases (up 94% in the last five years) as they relate to crime and street disorder; there are news stories daily on crime that Vancouver businesses are facing, impacting not only costs but also employee and customer safety, and fostering a negative image of Vancouver.

We encourage the City of Vancouver to take urgent action to make measurable reductions in the cost of doing business in Vancouver to ensure the survival of its business community and the health of the local economy. The Province of British Columbia must also take immediate steps to reduce business costs within its control – especially the cost of employment, property tax, street disorder, and worker housing for businesses in the province.

Download the Report.